History of The Wall Street Crash of 1929 & Beginning of the Great Depression

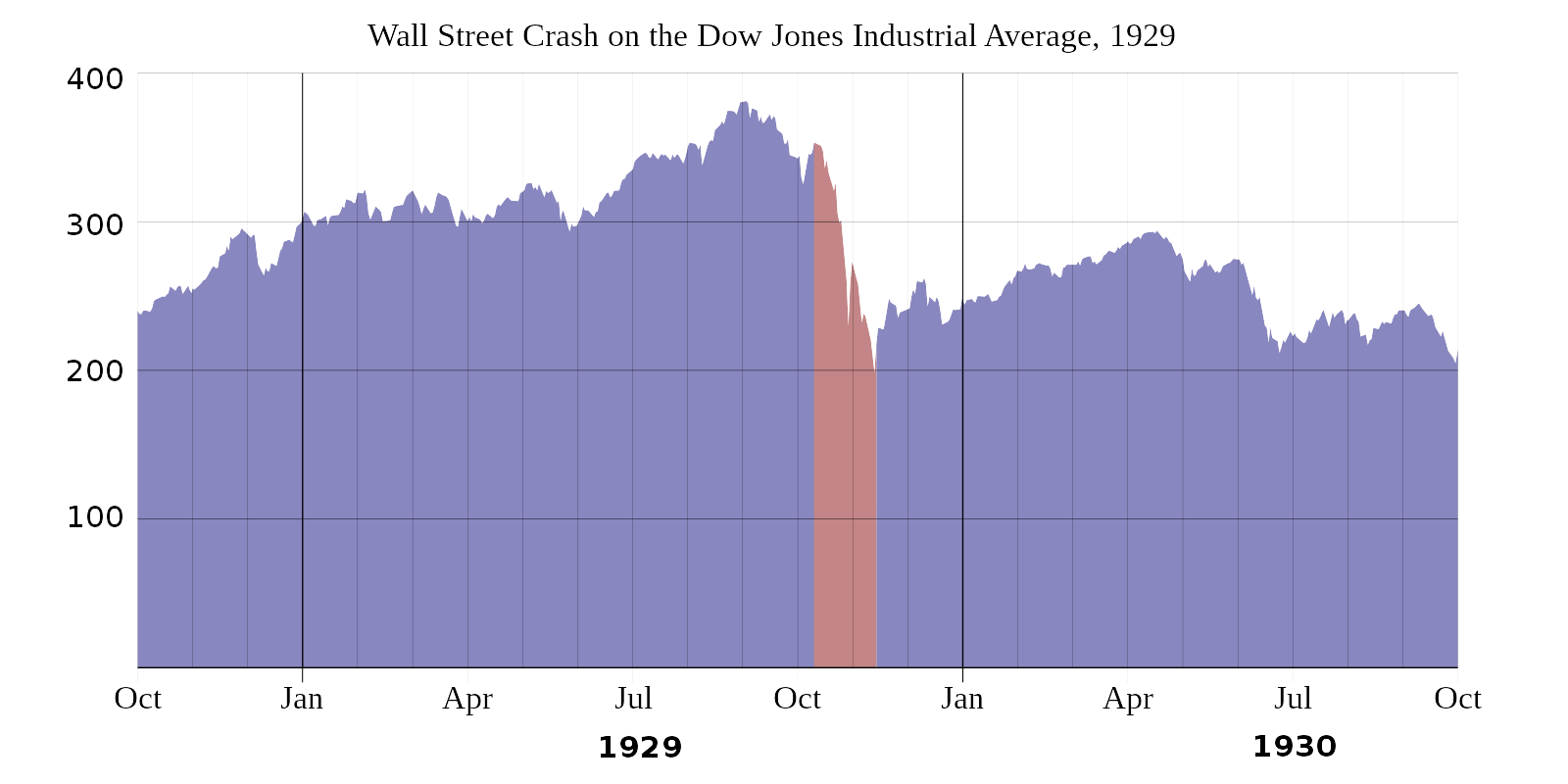

The 1929 Wall Street Crash, also known as the Great Crash or the Crash of ’29, marked a significant downturn in the U.S. stock market, unfolding in the fall of 1929. Beginning in September, the collapse of share prices on the New York Stock Exchange (NYSE) marked its onset, culminating around mid-November. This period is often emphasized for its stark contrast between the soaring bull market of the 1920s and the dramatic plunge of the NYSE in late 1929, a key factor in triggering the global Great Depression.

The 1929 Wall Street Crash, also known as the Great Crash or the Crash of ’29, marked a significant downturn in the U.S. stock market, unfolding in the fall of 1929. Beginning in September, the collapse of share prices on the New York Stock Exchange (NYSE) marked its onset, culminating around mid-November. This period is often emphasized for its stark contrast between the soaring bull market of the 1920s and the dramatic plunge of the NYSE in late 1929, a key factor in triggering the global Great Depression.

This crash stands as the most catastrophic in U.S. history, especially when considering the breadth and enduring impact of its consequences. The Great Crash is primarily linked with two specific dates: October 24, 1929, known as Black Thursday, which witnessed an unprecedented sell-off of U.S. shares, and October 29, 1929, or Black Tuesday, a day marked by the trading of around 16 million shares on the NYSE, a record in the annals of American financial history.

………….

Summary of 1929 Wall Street Crash

Background

- Economic Prosperity in the 1920s: The decade preceding the crash was marked by significant economic growth, industrial expansion, and rising stock prices. This era, known as the “Roaring Twenties,” saw a considerable increase in consumer spending and speculative investments.

- Speculative Bubble: A speculative bubble in the stock market began to develop. Driven by easy credit and the promise of continued economic growth, more people, including the general public, began investing in the stock market.

Events Leading to the Crash

- Market Peak in 1929: In early 1929, stock prices reached unprecedented levels. The Dow Jones Industrial Average (DJIA), a key market index, soared to new highs.

- Warning Signs: Despite the optimism, several warning signs indicated that the market was overheated. Some economists and investors began to express concerns about the inflated stock values and speculative nature of the market.

- Black Thursday (October 24, 1929): The initial crash occurred on Thursday, October 24, 1929. Panic selling began as investors realized that the market was overvalued. Stock prices plummeted, and the volume of trading was so high that the ticker tape machines couldn’t keep up.

- Black Monday and Black Tuesday (October 28-29, 1929): The most devastating selling came on the following Monday and Tuesday. On Black Tuesday alone, the market lost around 12% of its value, and millions of shares were traded.

Causes

- Speculative Bubble: The crash was primarily caused by the speculative bubble that had formed in the stock market during the preceding years.

- Buying on Margin: Many investors had bought stocks on margin, meaning they only paid a fraction of the stock’s value and borrowed the rest. When the market fell, these investors faced margin calls and had to sell off their stocks to cover their loans.

- Economic Disparities: The economy in the 1920s had underlying weaknesses, including income inequality and a reliance on consumer spending and speculative investments.

- Lack of Regulation: There was little government regulation or oversight of the stock market, contributing to reckless investment practices.

Aftermath and Consequences

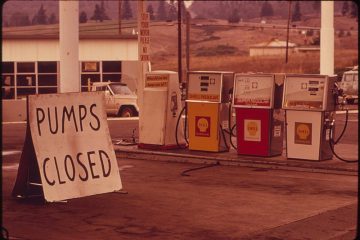

- Global Impact: The crash had a global impact, contributing to bank failures and economic downturns in various countries.

- The Great Depression: The stock market crash led to the Great Depression, characterized by massive unemployment, deflation, and a significant contraction of the economy.

- Policy Changes: In response to the crash and the ensuing depression, the U.S. government implemented significant financial reforms, including the Securities Act of 1933 and the Securities Exchange Act of 1934, which led to the creation of the Securities and Exchange Commission (SEC) to regulate the stock market.

- Government Response: President Herbert Hoover, who was in office at the time of the crash, attempted to address the economic crisis with various measures, but they were largely ineffective. Franklin D. Roosevelt, who succeeded Hoover, implemented the New Deal policies to stimulate economic recovery and provide relief to those affected by the depression.

The 1929 stock market crash remains one of the most studied events in economic history, symbolizing the dangers of speculative bubbles and the need for regulatory oversight in financial markets.

- Black Thursday (October 24, 1929):

- Morning: The stock market opened with a sharp drop in stock prices.

- Noon: Panic selling intensified as word of the declining market spread.

- Closing: The market closed with significant losses, but the full extent of the crash was not realized until later.

- Black Monday (October 28, 1929):

- Morning: The stock market opened with another substantial decline, causing widespread concern.

- Noon: The situation continued to deteriorate as stock prices fell further.

- Closing: The market closed with a significant loss, exacerbating the sense of crisis.

- Black Tuesday (October 29, 1929):

- Morning: Black Tuesday is the most infamous day of the crash. It began with a wave of panic selling.

- Noon: The selling pressure escalated dramatically, leading to a catastrophic collapse in stock prices.

- Closing: By the end of the day, the market had experienced an unprecedented crash, with billions of dollars in wealth wiped out in a single day.

MORE:

Detailed History of 1929 Wall Street Crash »

Main Image Source: Wikimedia Commons | Stock Exchange: Wikimedia Commons | Chart: Wikimedia Commons

Content Sources: Original | Generative AI | Wikipedia