History of Business in America: Dot-coms, Y2K, Subprime Crisis, Economic Ups and Downs (1990 – 2010)

History of Business in America: Dot-coms, Y2K, Subprime Crisis, Economic Ups and Downs (1990 – 2010)

The history of business in America from 1990 to 2010 encompasses a period of significant transformation, marked by technological advancements, globalization, and regulatory changes. This era saw the rise of the internet and digital technology, shifts in economic policies, and the impacts of two significant economic downturns. Here’s a detailed overview of this dynamic period:

…….

1990s

Technological Advancements:

The 1990s witnessed significant technological advancements, particularly in the realm of computing and telecommunications. The internet became increasingly accessible to the public, leading to the rise of e-commerce and the proliferation of internet-based businesses. Companies like Amazon, Google, and eBay emerged, transforming business models and consumer behavior.

Dot-com Bubble:

The latter half of the 1990s saw the emergence of the dot-com bubble, characterized by a rapid increase in the valuation of internet-related companies. Investors poured money into internet startups, many of which had little or no profitability. This speculative frenzy eventually led to the bursting of the bubble in the early 2000s.

Globalization:

American businesses expanded their operations globally, taking advantage of opportunities in emerging markets and participating in global supply chains. Free trade agreements, such as NAFTA, facilitated cross-border trade, although they also faced criticism for their impact on domestic industries and employment.

Financial Deregulation:

The repeal of the Glass-Steagall Act in 1999 under the Gramm-Leach-Bliley Act allowed for greater consolidation in the financial industry. This deregulation enabled the formation of financial conglomerates engaging in both commercial and investment banking activities.

Outsourcing and Offshoring:

American companies increasingly outsourced manufacturing and services to countries with lower labor costs, leading to concerns about job losses and the hollowing out of domestic industries. Offshoring became prevalent in industries like manufacturing, customer service, and information technology.

Corporate Consolidation:

The 1990s witnessed significant consolidation in various industries, including telecommunications, media, banking, and pharmaceuticals. Mergers and acquisitions were common strategies for companies seeking to expand market share and achieve economies of scale.

Corporate Scandals:

The early 2000s were marred by several corporate scandals, including Enron, WorldCom, and Tyco International. These scandals involved accounting fraud, insider trading, and other unethical practices, leading to increased scrutiny of corporate governance practices and regulatory reforms like the Sarbanes-Oxley Act of 2002.

Y2K:

Y2K, or the “Year 2000 problem,” was a global concern centered on the inability of older computer systems to correctly process the change from 1999 to 2000 due to the use of two-digit date codes. There were fears that this oversight would lead to widespread system failures. Extensive efforts were made worldwide to identify and fix Y2K issues in critical infrastructure, financial systems, and other sectors. Ultimately, as the new millennium began, the anticipated catastrophic failures did not occur, largely due to proactive measures taken to address the problem.

…….

Economic Downturns:

The early 2000s saw the bursting of the dot-com bubble, leading to a recession in 2001. The economy recovered but faced further challenges with the global financial crisis of 2008, triggered by the subprime mortgage crisis and the collapse of Lehman Brothers. These downturns impacted businesses across various sectors, leading to layoffs, bankruptcies, and restructuring efforts.

Housing Market Boom and Bust:

The 2000s saw a significant expansion of the housing market, fueled by easy credit and speculative investments in real estate. However, the housing bubble eventually burst, leading to a collapse in housing prices (“Subprime Mortgage Crisis“), mortgage defaults, and the subsequent financial crisis.

Government Intervention:

In response to the 2008 financial crisis, the U.S. government intervened with measures such as the Troubled Asset Relief Program (TARP) to stabilize financial institutions and prevent further economic collapse. The Federal Reserve also implemented monetary policy measures, including lowering interest rates and quantitative easing, to stimulate economic growth.

Emergence of Big Data and Analytics:

Towards the latter half of this period, there was a growing emphasis on data-driven decision-making in business. The proliferation of digital technologies and the internet led to the generation of vast amounts of data, prompting businesses to invest in analytics to derive insights for improving operations, marketing, and customer service.

Green Business and Sustainability:

In response to growing environmental concerns, businesses began to prioritize sustainability initiatives in the 2000s. Companies implemented measures to reduce carbon emissions, adopt renewable energy sources, and promote eco-friendly practices throughout their operations.

Overall, the period from 1990 to 2010 was characterized by technological innovation, globalization, economic turbulence, regulatory changes, and shifting consumer preferences, shaping the landscape of American business in significant ways.

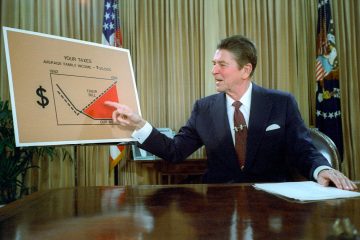

Main Image Source: Wikimedia Commons | CDs: Wikimedia Commons | Foreclosure Sign: Wikimedia Commons

Content Sources: Original | Generative AI