Subprime Mortgage Crisis Leads to the Great Recession

Subprime Mortgage Crisis Leads to the Great Recession

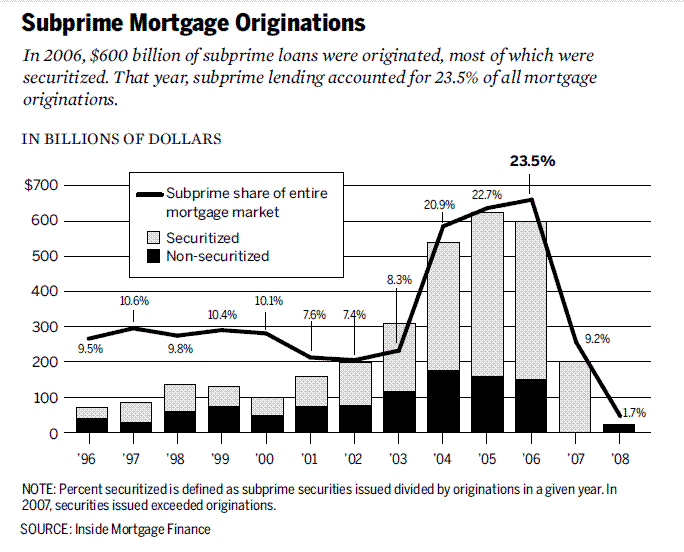

The subprime mortgage crisis, which reached its peak in 2008, was a devastating financial event characterized by a surge in the issuance of high-risk subprime mortgages, a speculative housing bubble, and the subsequent collapse of the housing market. As home prices plummeted, borrowers with adjustable-rate mortgages (ARMs) faced increasing financial strain, leading to widespread mortgage defaults and foreclosures. This crisis triggered a global financial panic, causing the failure of major financial institutions, massive government bailouts, and a severe economic recession called “The Great Recession.”

Early 2000s: The Housing Boom and Lax Lending Standards

- 2000-2005: The housing market experienced substantial growth, characterized by rising home prices and strong demand for housing.

- 2002-2003: Lenders began to relax lending standards, allowing borrowers with lower credit scores and riskier financial profiles to obtain mortgages (ie. subprime borrowers).

- 2003-2004: Adjustable-rate mortgages (ARMs) with low initial interest rates became popular, especially among subprime borrowers.

Proliferation of Subprime Mortgages (2005-2006)

- 2005: The subprime mortgage market continued to expand rapidly, with subprime mortgages making up a significant portion of all mortgage originations.

- 2006: Subprime lending reached its peak, as more borrowers with poor credit histories obtained loans, often with low teaser rates.

Housing Market Begins to Show Weakness (2006)

- Housing prices in some markets began to stagnate or decline, signaling potential problems ahead.

2007: The Bubble Bursts (2007)

- February 27, 2007: HSBC, one of the largest subprime lenders, announced a significant increase in loan delinquencies.

- July 2007: Two Bear Stearns hedge funds, heavily invested in mortgage-backed securities, faced massive losses and eventually collapsed.

- August 2007: BNP Paribas froze withdrawals from three of its investment funds due to concerns about the subprime mortgage market.

- September 2007: The Federal Reserve cut the federal funds rate for the first time in over four years in response to the unfolding crisis.

- September 15, 2007: Lehman Brothers filed for bankruptcy, marking one of the first major casualties of the crisis.

2008: Global Financial Meltdown (2008)

- March 2008: The Federal Reserve provided emergency funding to Bear Stearns, which was on the brink of collapse. Bear Stearns was later acquired by JPMorgan Chase.

- July 2008: The U.S. government took control of Fannie Mae and Freddie Mac, two government-sponsored enterprises involved in the mortgage market.

- September 7, 2008: The U.S. government seized control of Fannie Mae and Freddie Mac, injecting massive amounts of capital to prevent their collapse.

- September 15, 2008: Lehman Brothers filed for bankruptcy, sending shockwaves through the global financial system.

- September 16, 2008: The Federal Reserve bailed out insurance giant American International Group (AIG) with an $85 billion loan.

- September 29, 2008: The U.S. Congress rejected the initial proposed bailout plan known as the Troubled Asset Relief Program (TARP).

- October 3, 2008: The Emergency Economic Stabilization Act of 2008, which included the Troubled Asset Relief Program (TARP), was signed into law.

- October 13, 2008: The U.S. government began injecting capital into major banks, initiating a series of bank bailouts.

2008-2009: Economic Fallout (2008-2009)

- The global financial crisis led to a severe economic recession, marked by rising unemployment, declining consumer spending, and falling GDP growth.

Post-Crisis Reforms (Post-2008)

- July 21, 2010: The Dodd-Frank Wall Street Reform and Consumer Protection Act was signed into law, aiming to overhaul financial regulations and prevent future crises.

- Ongoing Post-Crisis: Regulatory reforms, enhanced oversight, and risk management improvements were introduced to prevent a recurrence of the crisis.

The subprime mortgage crisis was a complex and multifaceted event that unfolded over several years, marked by a series of key dates and events that shook the global financial system. It highlighted the dangers of lax lending standards, the complexity of financial products, and the need for robust regulatory oversight in the financial industry.

MORE:

Detailed History of Subprime Mortgage Crisis »

History of “The Great Recession” in U.S. »

History of 2007-2008 Financial Crisis »

Main Image Source: Wikimedia Commons | Chart: Wikimedia Commons

Content sources: Original | Generative AI | Wikipedia