The Panic of 1907, also known as the 1907 Bankers’ Panic, was a financial crisis that occurred in the United States in the early part of 1907. The panic resulted in a severe contraction of credit markets, a series of bank runs, and ultimately led to the intervention of notable financiers to stabilize the financial system.

Key Points

Background:

The U.S. economy was experiencing rapid growth during the early 20th century, but it was also characterized by financial speculation and an inadequate regulatory framework for banking and finance.

Trigger Events:

The panic was triggered by a series of events, including the failed attempt to corner the copper market by F. Augustus Heinze, a copper magnate, and a subsequent drop in the stock prices of Heinze-related companies. This led to a run on banks associated with Heinze, creating a domino effect.

Bank Runs:

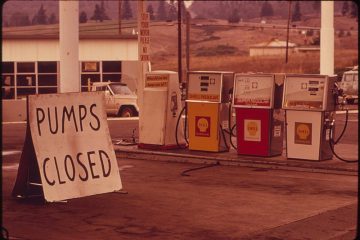

As news of financial troubles spread, depositors began to withdraw their money from banks out of fear of bank insolvency. This resulted in a series of bank runs, where individuals and businesses rushed to withdraw their deposits, causing a liquidity crisis.

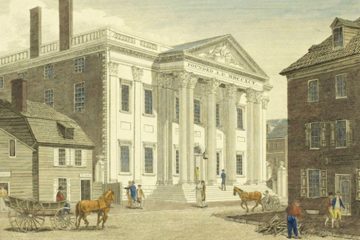

Role of Knickerbocker Trust Company:

The situation worsened when the Knickerbocker Trust Company, a major trust company in New York City, experienced a run. Its failure intensified the panic, spreading fear and leading to further bank runs.

Intervention by J.P. Morgan:

In an effort to stabilize the financial system, J.P. Morgan, one of the most influential financiers of the time, organized a team of bankers to provide liquidity to threatened banks. This intervention included infusing money into the system and convincing other bankers to do the same.

Formation of the National Monetary Commission:

The panic highlighted the need for banking and monetary reform. In response, the U.S. Congress established the National Monetary Commission in 1908 to study the causes of the panic and propose reforms.

Impact:

The Panic of 1907 underscored the vulnerabilities in the U.S. financial system and contributed to the push for the creation of the Federal Reserve System. The Federal Reserve Act was passed in 1913 to provide a more stable banking and financial structure, with the goal of preventing future panics and bank runs.

The Panic of 1907 played a crucial role in shaping the trajectory of U.S. financial regulation and ultimately contributed to the establishment of the Federal Reserve System as the central bank of the United States.

MORE: