History of the U.S. Federal Reserve

History of the U.S. Federal Reserve

The Federal Reserve System (often referred to as the Fed) is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of financial panics (particularly the panic of 1907) led to the desire for central control of the monetary system in order to alleviate financial crises. Over the years, events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsibilities of the Federal Reserve System.

Key Historical Dates

Late 19th and Early 20th Centuries: Before the establishment of the Federal Reserve, the United States experienced periodic financial panics and banking crises. The country lacked a central banking system, and monetary policy was decentralized.

1907 Financial Panic: The Panic of 1907 highlighted the need for a more effective and centralized banking system. Banker J.P. Morgan played a pivotal role in stabilizing the financial system during this crisis, but there was a growing consensus that a formalized solution was needed.

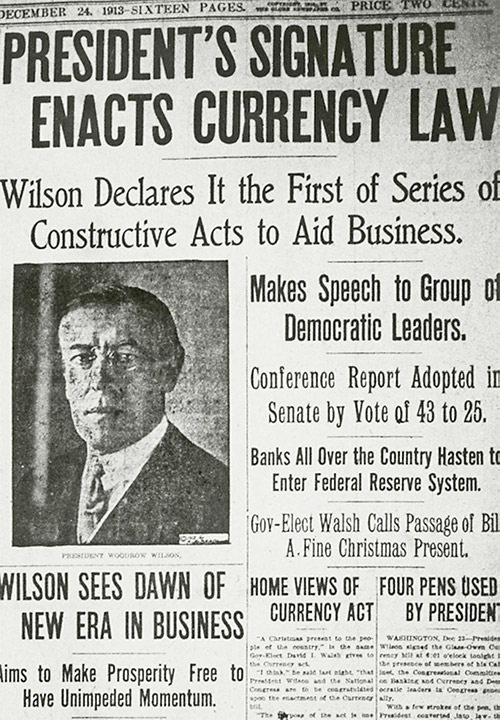

December 23, 1913: The Federal Reserve Act is signed into law by President Woodrow Wilson, establishing the Federal Reserve System. The act aimed to provide the United States with a more stable and flexible monetary and financial system.

November 16, 1914: The Federal Reserve officially opens for business, with 12 regional banks established across the country. Each of these banks serves as a “lender of last resort” to member banks in its district.

1920s-1930s: The Federal Reserve faces challenges during the Great Depression. The Banking Act of 1933, also known as the Glass-Steagall Act, introduces significant changes to the Federal Reserve System.

December 7, 1941: The attack on Pearl Harbor occurs, leading to the United States’ entry into World War II. The Federal Reserve plays a crucial role in financing the war effort.

July 1, 1944: The Bretton Woods Agreement is established, creating a fixed exchange rate system and solidifying the U.S. dollar as the world’s primary reserve currency.

1951: The Treasury-Federal Reserve Accord is reached, ending the Federal Reserve’s obligation to support the prices of government securities. This marks a significant step toward the central bank’s independence.

1971: President Richard Nixon announces the suspension of the convertibility of the U.S. dollar into gold, effectively ending the Bretton Woods system and ushering in an era of floating exchange rates.

1979: Paul Volcker becomes Chairman of the Federal Reserve. Under his leadership, the Fed adopts a more aggressive approach to combating inflation, ultimately leading to a significant increase in interest rates.

1987: The Federal Reserve, under Chairman Alan Greenspan, responds to the “Black Monday” stock market crash by providing liquidity to financial markets.

2000s: The Federal Reserve, led by Chairman Alan Greenspan and later Ben Bernanke, faces the bursting of the dot-com bubble and implements policies to address economic challenges, including the 2007-2008 financial crisis.

September 15, 2008: Lehman Brothers files for bankruptcy, triggering a severe financial crisis. The Federal Reserve, under Chairman Ben Bernanke, implements unprecedented measures to stabilize the financial system, including massive interventions and interest rate cuts.

2010: The Dodd-Frank Wall Street Reform and Consumer Protection Act is signed into law, introducing significant regulatory reforms in response to the 2008 financial crisis.

2020: The Federal Reserve responds to the economic impact of the COVID-19 pandemic by implementing various measures, including lowering interest rates, asset purchases, and providing support to financial markets.

Federal Reserve Chair by Date:

William Gibbs McAdoo (December 23, 1913- August 10, 1914)

Charles Hamlin (August 10, 1914 – August 9, 1916)

William Harding (August 10, 1916 – August 9, 1922)

Daniel Crissinger May 1, 1923 – September 15, 1927)

Roy Young (October 4, 1927 – August 31, 1930)

Eugene Meyer (September 16, 1930 – May 10, 1933)

Eugene Black (May 19, 1933 – August 15, 1934)

Marriner Eccles (November 15, 1934 – January 31, 1948)

Thomas McCabe (April 15, 1948 – March 31, 1951)

Bill Martin (April 2, 1951 – January 31, 1970)

Arthur Burns (February 1, 1970 – January 31, 1978)

William Miller (March 8, 1978 – August 6, 1979)

Paul Volcker (August 6, 1979 – August 11, 1987)

Alan Greenspan (August 11, 1987 – January 31, 2006)

Ben Bernanke (February 1, 2006 – January 31, 2014)

Janet Yellen (February 3, 2014 – February 3, 2018)

Jay Powell (February 5, 2018 – Incumbent)

The Secret Meeting at Jekyll Island

The meeting at Jekyll Island is a historical event that took place in 1910 and played a significant role in the establishment of the Federal Reserve System in the United States. The meeting was held in secret at the Jekyll Island Club, a private club on Jekyll Island, Georgia, and it brought together a group of influential bankers and financial experts.

The meeting at Jekyll Island is a historical event that took place in 1910 and played a significant role in the establishment of the Federal Reserve System in the United States. The meeting was held in secret at the Jekyll Island Club, a private club on Jekyll Island, Georgia, and it brought together a group of influential bankers and financial experts.

Here’s a brief overview of the meeting and its key participants:

Participants:

Nelson Aldrich: U.S. Senator and father-in-law to John D. Rockefeller Jr.

Abraham Piatt Andrew: Assistant Secretary of the Treasury.

Frank Vanderlip: President of National City Bank of New York.

Henry Davison: Senior partner at J.P. Morgan & Co.

Charles Norton: President of the First National Bank of New York.

Benjamin Strong: Head of J.P. Morgan’s Bankers Trust Company.

Paul Warburg: Partner in Kuhn, Loeb & Co.

Purpose:

The primary purpose of the meeting was to discuss and draft a plan for banking and monetary reform in the United States. The participants were concerned about the volatility of the banking system and sought to create a more stable financial structure.

Secrecy:

The meeting was conducted in secret, with participants using aliases to avoid drawing attention. This secrecy was partly due to the sensitive nature of the discussions and the fear of public backlash against what might be perceived as a gathering of powerful bankers conspiring against the public interest.

Outcome:

The discussions at Jekyll Island laid the groundwork for the Aldrich Plan, named after Nelson Aldrich, which proposed the establishment of a central banking system in the United States. While the Aldrich Plan was not directly adopted, its principles influenced the development of the Federal Reserve Act of 1913, which eventually led to the creation of the Federal Reserve System.

The Federal Reserve System was established to provide a more stable and flexible monetary and financial system, with the central bank serving as a lender of last resort and regulator of the money supply. The events at Jekyll Island are considered a crucial precursor to the formation of the Federal Reserve, and they highlight the complex relationship between financial interests, government, and the need for a stable banking system.

MORE: