Summary History of The Panic of 1796–1797 in Early American History

Summary History of The Panic of 1796–1797 in Early American History

The Panic of 1796–1797 was a severe financial crisis in the United States, sparked by rampant speculation in land and exacerbated by a sudden withdrawal of British capital, leading to bank failures and widespread economic distress. As speculative land values collapsed, many investors faced ruin, triggering a contraction in the broader economy. The crisis underscored the fragility of the young nation’s financial system and highlighted the need for better regulatory oversight, shaping future debates on the role of government in managing economic stability.

——–

Details

Post-Revolutionary Economic Landscape:

- Following the American Revolutionary War and the subsequent establishment of the United States, the nation experienced a period of economic growth and expansion. This optimism was fueled by newfound independence, territorial acquisitions, and prospects for economic prosperity.

Speculative Frenzy in Land and Securities:

- The post-war period saw a speculative boom, particularly in the real estate and land markets. Investors, including wealthy individuals and speculators, engaged in frenzied land speculation, purchasing vast tracts of land with borrowed money in the hopes of significant returns.

- Speculation also extended to securities and financial instruments, with investors seeking opportunities for quick profits. This speculative fervor was facilitated by easy credit from banks and a lack of financial regulation.

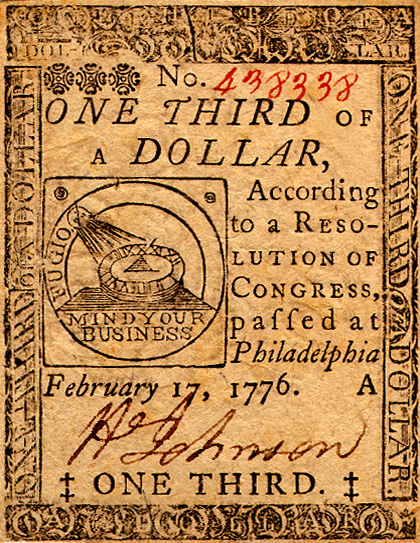

Inflation of Continental Currency

- Rampant inflation of Continental Currency during the Revolutionary War gave rise to the phrase “not worth a Continental”. Lacking a stable currency, banks issued their own notes, and calls for stronger public credit led to the establishment under the Articles of Confederation of the Bank of North America in 1781. After the adoption of the Constitution, the First Bank of the United States succeeded it as a de facto central bank. Concerns remained, however, over the strength of public credit as unstable banknotes remained a medium of exchange.

Expansion of Credit and Banking:

- Both public and private banks played a significant role in fueling the speculative bubble by extending credit to investors. However, much of this credit was based on speculation rather than underlying economic productivity, leading to an unsustainable expansion of the money supply.

International Context:

- The Panic of 1796-1797 was influenced by international events, including the French Revolution and the subsequent Napoleonic Wars in Europe. These conflicts disrupted global trade patterns and financial markets, affecting the United States’ economy due to its interconnectedness with European markets.

Agricultural Struggles and Economic Pressures:

- The United States experienced challenges in its agricultural sector, with poor harvests leading to food shortages and rising prices. Agriculture was the primary economic activity at the time, and these difficulties had widespread repercussions for the economy.

Emergence of Financial Crisis:

- By 1796, signs of economic strain began to emerge as the speculative bubble reached its peak. Increasingly, investors became wary, and doubts about the sustainability of the speculative boom grew.

- A series of events, including bank failures and defaults, triggered a full-blown financial panic in 1796-1797. Banks suspended payments in specie (gold and silver), leading to widespread panic among depositors and a loss of confidence in the banking system.

Economic Fallout and Social Impact:

- The panic resulted in a significant economic downturn, with businesses failing, unemployment rising, and many individuals losing their life savings. The crisis had profound social and political ramifications, exacerbating existing tensions between different economic and political factions.

Government Response:

- In response to the crisis, the federal government under President George Washington and later President John Adams took measures to stabilize the economy. These included the issuance of government bonds to inject liquidity into the financial system and restore confidence.

Long-Term Effects:

- While the Panic of 1796-1797 eventually subsided, its effects were felt for years. The crisis underscored the need for a more stable and regulated financial system, beyond the establishment of the First Bank of the United States a few years earlier in 1791, and subsequent efforts to develop a more centralized banking system.

Downfalls & Debtors

- By 1800, the economic upheaval had led to the downfall of several notable trading houses in cities such as Boston, New York, Philadelphia, and Baltimore, bringing many American borrowers, including celebrated figures like Robert Morris, a key financier during the revolutionary era, and his associate James Greenleaf, who had ventured into frontier land investments, to imprisonment. James Wilson, a justice on the U.S. Supreme Court, was compelled to evade creditors until his demise at a friend’s residence in Edenton, North Carolina. George Meade, whose grandson would become a Union General in the Civil War, faced financial ruin due to speculative investments in western lands, culminating in bankruptcy. Similarly, the wealth of Henry Lee III, the progenitor of Confederate General Robert E. Lee, dwindled due to speculative activities with Robert Morris.

- The jailing of the prominent figures like Wilson and Morris for debt led to legislative action, with Congress enacting the Bankruptcy Act of 1800. This legislation laid the groundwork for a cooperative resolution between creditors and debtors, although it faced criticism for potentially encouraging speculative risks by mitigating the consequences of failure. Despite its repeal in 1803, the act marked an important development in American legal history by moving away from the practice of debtor imprisonment.

From a business history perspective, the Panic of 1796–1797 was a seminal event that underscored the volatility and risks inherent in emerging markets. It highlighted the critical importance of sound financial practices, the dangers of speculative excess, and the interconnectedness of global and domestic markets. The lessons learned from this crisis informed the evolution of American business practices, contributing to the development of a more mature and resilient commercial environment.

MORE:

Detailed History of The Panic of 1796–1797 »

Main Image Source: Wikimedia Commons | Continental Currency: Wikimedia Commons

Content sources: Original | Generative AI | Wikipedia